Time Decay & Commodity OptionsProvided By Options University How Time Decay Affects Commodity Options

Time decay, also known as theta, is defined as the rate by which

a commodity options value erodes into expiration. The value

of the commodity options over parity to the stock is called

extrinsic value.

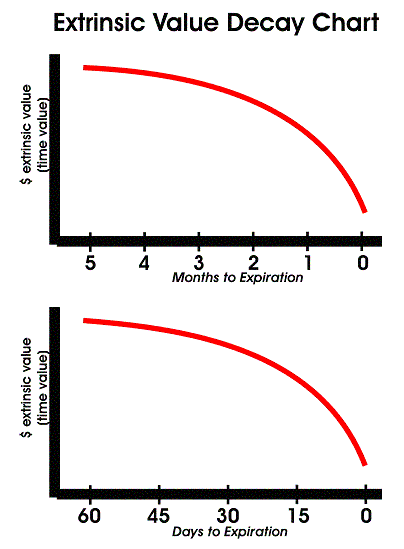

Since commodity options are a depreciating asset, meaning they have a limited life, the extrinsic value in the commodity options will wither away daily until expiration. This decay is not a linear function meaning it is not equally distributed between all of the days to expiration. As the commodity options gets closer to expiration, the daily rate of decay increases and continues to increase daily until expiration of the commodity options. At expiration, all commodity options in the expiration month, calls and puts, in-the-money and out-of-the-money must be completely devoid of extrinsic value as noted in the time value decay charts below. As more time goes by, the commodity options extrinsic value decreases. Again, it is important to note that the rate of this decrease is not linear, meaning not smooth and even throughout the life of the option contract. An option contract starts feeling the decay curve increasing when the option has about 45 days to expiration. It increases rapidly again at about 30 days out and really starts losing its value in the last two weeks before expiration. This is like a boulder rolling down a hill. The further it goes down the hill, the more steam it picks up until the hill ends. By selling the commodity options and owning the stock, the covered call seller captures the extrinsic value in the option by holding the short call until expiration. By selling the commodity options and owning the stock, the covered call seller captures the extrinsic value in the option by holding the short call until expiration. At The Money Call vs. In The Money Call

At The Money Call vs. In The Money Call

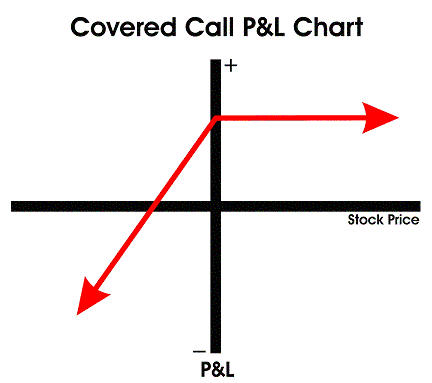

Key Point The covered call strategy provides the investor with another opportunity to gain income from a long stock position. The strategy not only produces gains when the stock trades up, but also provides above average gains in a stagnant period, while offsetting losses when the stock declines in price. We have now seen how a covered call strategy is constructed and how it is supposed to work. Keep in mind that the trade can be entered into in two ways. You can either sell calls against stock you already own (Covered Call) or you can buy stock and sell calls against them at the same time (Buy Write). Example 1 You own 1000 shares of Oracle at $9.50. The stock has been stuck around this level for a long time now and you have grown impatient. You finally give in and sell the front month (November for example) at-the-money calls. The at-the-money calls would have a strike price of $10 if the stock was trading at $9.50. You sell the calls at a $.50 premium per contract which creates a $10.50 breakeven point. Remember, in a buy-write, the breakeven point is the strike price plus the option premium. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Commodity Options

|