Vertical Option SpreadsProvided By Options University Option Spreads - Cost Relationship Between Corresponding Put Spreads & Call Spreads

We have demonstrated that vertical option spreads have intrinsic

value, and that we can roughly determine their value by comparing

stock price to strike prices. There is another relationship

that can help investors determine value. That is the relationship

that exists between corresponding vertical option spreads.

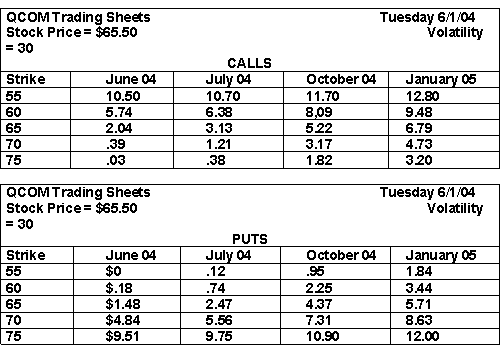

When we use the term corresponding we mean the same month, the same strikes in the same stock. The only difference is between calls and puts. For example, the XYZ Sept. 30 35 vertical call spreads corresponding option spreads would be the XYZ Sept. 30 35 vertical put spread. Similarly, the ABC June 70 80 put spreads corresponding option spreads would be the ABC June 70 80 call spread. The importance of understanding the relationship of corresponding vertical option spreads is that the sum of a vertical call spread and its corresponding vertical put spread is going to be equal to the difference between the two strikes. If the April 30 35 call option spreads trades at $2.00, then the April 30 35 put spread will be worth $3.00. Lets review this. The difference of the two strikes is $5.00 and the cost of the call spread is $2.00. That means the cost of the put option spreads will be $3.00. The chart below is a floor traders pricing sheet that shows where individual options are trading and what they are worth based on each traders individual inputs. From this we can calculate the price of any of our option spreads. Pick any vertical spread. Now, calculate the value of a vertical call spread or a vertical put spread. Once youve done that, calculate the value of its corresponding vertical spread. Add the two option spreads together and see if that sum is equal to the difference between the two strikes. Perform the calculations several times on different vertical spreads. Try it on $5, $10 and even $15 spreads.  Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Option Spreads

|