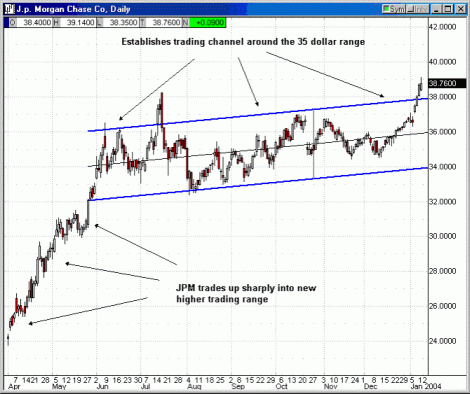

JPM Daily Chart Covered Call Options Trading Example #2Provided By Options University What Kinds Of Return You Can Expect From Your Trade Options NOTES OF J.P.MORGAN (JPM) Covered Call options trading

1. By June of 2003, JPM had traded up from a lower options trading range in the $25.00 area to a new range around $35.00.

2. Since entering the new options trading range in June, the stock has consolidated into a relatively flat, horizontal options trading channel. For the most part, this channel is only around $3.00 to $4.00 wide. 3. This options trading channel is not only tight, but it seems to be equally dispersed around the $35.00 mark. The stock does not seem to venture very far on either side of $35.00. 4. From the time that the stock enters the options trading channel, the range of the channel has been decreasing or tightening, which indicates decreasing volatility. Conclusion: JPM sets up a classic text book buy-write opportunity above. After finding a new options trading range, the stock consolidates into a tight, options trading channel that is almost horizontal. Further, this channel tightens and does not deviate from $35.00 to the point where it even comes close to a channel line violation. Here, an investor would most likely be interested in writing the 35 strike price calls to collect premium as the stock trades sideways. Obviously, there is no way to predict how long a stock will consolidate like this, but the risks are low, and in this case the covered call strategy would have returned some very nice, low risk returns over this period. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Options Trading

|