Part 2: Parity & Stock OptionsProvided By Options University How Parity Will Affect Your Stock Options

As stated earlier, call options are contracts between two parties

(a buyer and a seller) whereby the buyer acquires the right,

but not the obligation, to purchase specified options or other

underlying instrument, at a predetermined price on or prior

to a specified date.

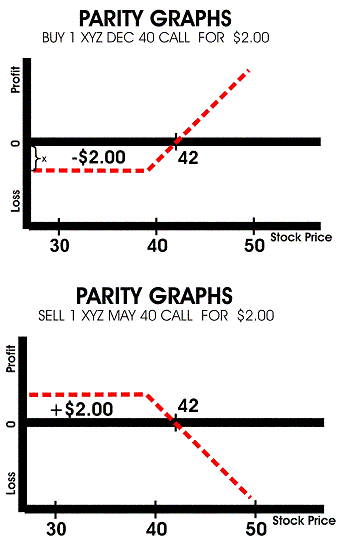

The seller of call options assumes the obligation of delivering the stock or other underlying instrument to the buyer should the buyer wish to exercise his options. The call is known as a long instrument, which means the buyer profits from the options going up, and the seller hopes the options go down or remains the same. For the buyer to profit, the options must move above the strike price plus the amount of money spent to purchase the options. This point is known as the breakeven point and is calculated by adding the strike price of the call to its premium. While the buyer hopes the options price exceeds this point, the seller hopes that the options stay below the breakeven point. The buyer of the call has limited risk and unlimited potential gain. His risk is limited only to the amount of money he spent in purchasing the call. His unlimited potential gain comes from the options upside growth potential. The seller, on the other hand, has limited potential gain and unlimited potential loss. The seller can only gain what he was paid for the call. His unlimited risk comes from the options prices ability to rise during the life of the contract. The seller is responsible for delivering the options to the buyer at the strike price regardless of the present market price of the options. This is why the seller receives premium for the sale. It is compensation for taking on this risk. For example, if a seller sold the MSFT January 65 call for $2.00, he is giving the buyer the right to buy 100 shares (per contract) of MSFT from him for $65.00 per share at any time until the option expires. If MSFT rallies and trades up to $75.00, the seller would realize a $10.00 loss less the amount he received for the sale of the options ($2.00). Meanwhile, the buyer would realize a $10.00 profit less the amount he paid for the options ($2.00). If MSFT were to trade down to $55.00, the seller would realize a $2.00 profit (the amount of money he was paid from the buyer). Meanwhile, the buyer would only lose what he paid for the options ($2.00). The following graphs are called parity graphs. They are intended to show you your options profit and loss at expiration (when they are trading at parity: i.e. when they are trading without intrinsic value). The first graph shows a call purchase and the second shows a call sale. The graphs show the amount of your expenditure (in the case of a purchase) or the amount you have received (in the case of a sale) and the dollar price of the options where you would breakeven. In this example, we use the fictitious stock XYZ. Please make note of where the stock needs to be at expiration in order for you to be profitable, and how the premium paid (in the case of a purchase) or the premium received (in the case of a sale) affects your profitability. Also notice the difference in the profit potential between a purchase of the options as opposed to a sale of the options. Lastly, it is important to note the unlimited potential risk inherent in the sale of the options, compared to the fixed risk of an options purchase.

Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Options

|