Difference Between In-The-Money (ITM), Out-Of-The-Money (OTM) Or At-The-Money (ATM) In Stock Option InvestingProvided By Options University There Is Much To Learn Before You Can Be Confident & Successful At Stock Option Investing

An option in stock option investing can be described by its

strike prices proximity to the stocks price. An option in

stock option investing can either be in-the-money (ITM), out-of-the-money

(OTM), or at-the-money (ATM).

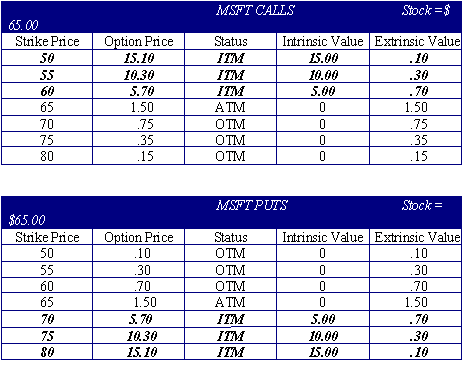

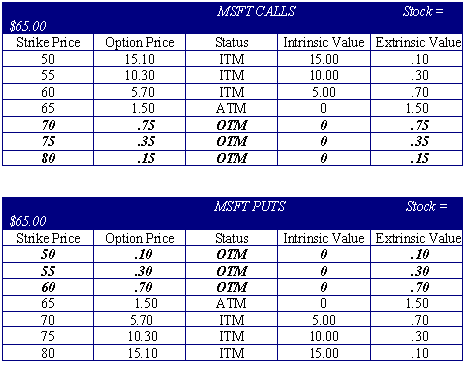

An at-the-money option in stock option investing is described as an option whose exercise or strike price is approximately equal to the present price of the underlying stock. An example of stock option investing, if Microsoft (MSFT) was trading at $65.00, then the January $65.00 call would an example of an at-the-money call option. Similarly, the January $65.00 put would be an example of an at-the-money put option. An in-the-money call option in stock option investing is described as a call whose strike (exercise) price is lower than the present price of the underlying. An in-the-money put is a put whose strike (exercise) price is higher than the present price of the underlying In our stock option investing example above, an in-the-money call option would be any listed call option with a strike price below $65.00 (the price of the stock). So, the MSFT January 60 call option would be an example of an in-the-money call. The reason is that while stock option investing, at any time prior to the expiration date, you could exercise the option and profit from the difference in value: in this case $5.00 ($65.00 stock price - $60.00 call option strike price = $5.00 of intrinsic value). In other words, the option is $5.00 in-the-money. Using our stock option investing example, an in-the-money put option would be any listed put option with a strike price above $65.00 (the price of the stock). The MSFT January 70 put option would be a stock option investing example of an in-the-money put. It is in-the-money because at any time prior to the expiration date, you could exercise the option and profit from the difference in value: in this case $5.00 ($70.00 put option strike price - $65.00 stock price = $5.00 of intrinsic value. In other words, the option is $5.00 in-the-money. Please view charts below for more in-the-money stock option investing examples:  An out-of-the-money call when stock option investing is described as a call whose exercise price (strike price) is higher than the present price of the underlying. Thus, an out-of-the-money call options entire premium consists of only extrinsic value. There is no intrinsic value in an out-of-the-money call when stock option investing, because the options strike price is higher than the current stock price. For example, if you chose to exercise the MSFT January 70 call while the stock was trading at $65.00, you would essentially be choosing to buy the stock for $70.00 when the stock is trading at $65.00 in the open market. This action would result in a $5.00 loss. Obviously, you wouldnt do that while stock option investing. An out-of-the-money put has an exercise price that is lower than the present price of the underlying. Thus, an out-of-the-money put options entire premium consists of only extrinsic value. There is no intrinsic value in an out-of-the-money put because the options strike price is lower than the current stock price. For example, if you chose to exercise the MSFT January 60 put while the stock was trading at $65.00, you would be choosing to sell the stock at $60.00 when the stock is trading at $65.00 in the open market. This action would result in a $5.00 loss. Obviously, you would not want to do that when stock option investing. Please view charts below for out-of-the-money stock option investing option examples:  Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Stock Option Investing

|