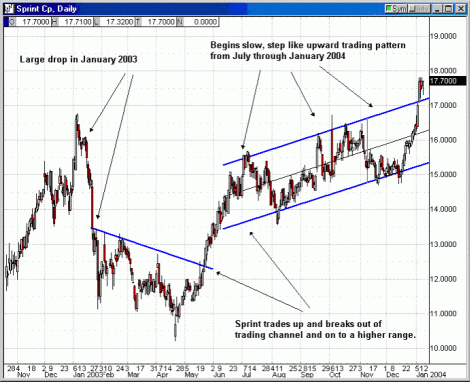

FON Daily Chart Covered Call Stock Option Trading Example #4Provided By Options University A Sprint Stock Option Trading Example NOTES ON SPRINT (FON) Covered Call stock option trading

1. After a large drop at the end of Jan 2003, Sprint consolidates

around $12.00 and trades in a relatively tight stock option

trading range, around $12.00, for approximately 5 months or

until mid-May 2003. This period is the first opportunity for

premium collection.

2. At the end of May 2003, Sprint trades up to the top of its stock option trading range in a slow, methodical way, indicating a period of decreasing volatility. 3. Sprint breaks out of old stock option trading range by trading through resistance set by the 2 highs in February, around $13.25. It develops a new stock option trading range at the $15.00 level by trading up in a slow, step like pattern which also indicates a period of decreasing volatility. 4. Sprint trades around the $15.50 range and really tightens up around October 2003 thru January 2004. This again, is a long period of decreasing volatility. Conclusion: Sprint shows two favorable patterns here that are friendly to covered call writing. The first is that Sprint shows the tendency to trade in a tight range for extended periods of time, as seen in Feb. May 2003 and Jul. Dec. 2003. This is advantageous for premium collection. The second is that when Sprint does move, it mostly trades up in a slow, directional type of move, as opposed to gapping (with the exception of Jan. 2003). These slow upward directional moves work well for covered call writers in two ways; capital appreciation and premium capturing. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Stock Option Trading

|