Advantages and Disadvantages of at-the-money option, in-the-money option and out-of-the-money stock options picksProvided By Options University How To Trade The Different Kinds Of Stock Options Picks

At-the-money stock options picks has both advantages and disadvantages

over stock and in-the-money stock options picks. First, the

at-the-money stock options picks will be cheaper then both the

stock and the in-the-money stock options picks. So there is

less capital requirement and less total risk.

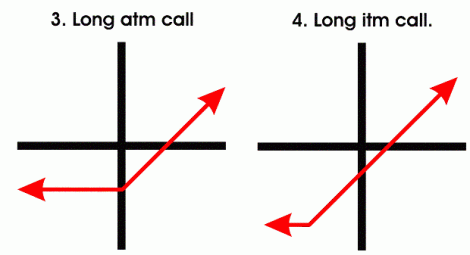

Remember, when buying stock options picks, you can only lose what you spend. The problem is the amount of extrinsic in the at-the-money option. In order for you to profit from buying an at-the-money stock options picks, you need the stock to make a move very quickly. Because you have so much extrinsic value, you will be battling against the options daily rate of decay. So, the movement of the stock options picks must happen quickly enough and large enough to offset the amount of money you will be losing daily as expiration draws near. With this said, the best chance you have to make money when buying a naked at-the-money option is to use it as a short term trade. The longer you hold onto the stock options picks, the harder it is for you to be profitable due to the options decaying extrinsic value. At The Money Call vs. In The Money Call  For chart below, stock price = $35.00

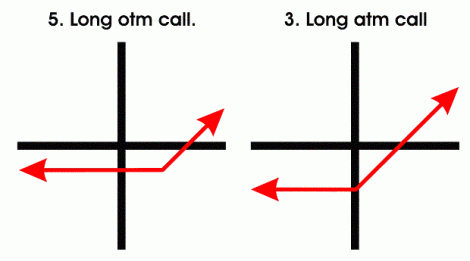

Out-of-the-money stock options picks presents many of the same advantage & disadvantage parameters to the investor. The out-of-the-money stock options picks are even cheaper then the at-the-money option which means more leverage and less risk. However, with a smaller delta, the stock options picks must move much more than either the in or at-the-money options in order for the options to become profitable. Again, we need the options delta to outpace the stock options picks rate of decay. Now, with the out-of-the-money option, there is less extrinsic value than the at-the-money stock options picks so the amount of total possible decay (cost of the option) and the rate of this decay is less than the at-the-money option. By being further out-of-the-money, the stock options picks needs more movement from the stock. As a naked option, this out-or-the-money example is extremely speculative and should only be used naked when the investor feels there is a very good chance of the stock options picks having a large percentage move. An investor must understand that the odds of them profiting from the purchase of a naked out-of-the-money option is very slim. When purchasing a naked out-of-the-money option, be prepared to lose your entire investment. Out of The Money Call vs. At The Money Call  For chart below, stock price = $35.00

Although options can be traded by themselves for directional plays, and can perform well under the right conditions, they are much better used in coordination with stock or other stock options picks in formatted strategies. While buying naked calls and puts can provide some of the biggest leverage and highest returns, they can also involve the most risk. This strategy should only be used by experienced options traders or traders using risk capital. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Stock Options Picks

|