Advanced Strategies For Trading Stock Options (part 1)Provided By Options University More Profitable Strategies For Trading Stock OptionsThe Stock Replacement Covered Call Strategy For Trading Stock Options

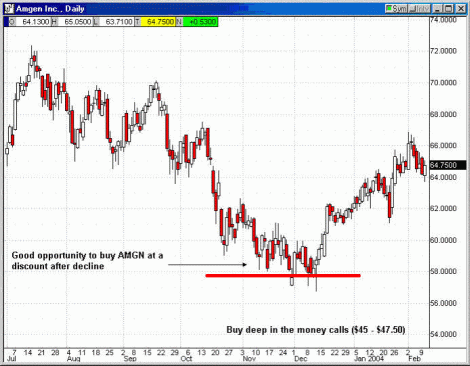

Recently, (October and November 03), the giant biotech Amgen

(AMGN) came under some intense pressure, trading down about

$12.00 before it found what appeared to be a decent level of

support, and began to consolidate. At this level, anyone interested

in going long Amgen at a discounted price would be advised to

do so. Implied volatility was high coming off this precipitous

drop, which caused premiums in the options to increase considerably.

This scenario can be a very attractive for trading stock options or buy-writers. On Tuesday, December 2, 2003, Amgen was trading at $58.90, the December 60 call was trading at $1.30, and there were only two weeks left until expiration.  Lets assume that you wanted to start trading stock options due to this great opportunity but you would be unable to participate in it due to capital requirements. They started trading stock options at $58.90 and you did not have sufficient funds to support trading stock options at that price. After all, the purchase of just 1000 shares would cost $58,900.00. This is the time to consider using a trading stock options strategy called stock replacement. In many instances, an insufficient amount of funds in the investors account can mean the loss of a golden trading stock options opportunity when dealing with high dollar priced stocks. So, an alternative to purchasing the trading stock options outright is to find a way to replace the actual trading stock options with something else which is not as expensive. In this case, a deep in-the-money call would do just that. When a call is deep in-the-money, meaning that the strike price of the call is much lower than the trading stock options price, the delta of the call approaches 100. This means that there is close to a 100% chance that these trading stock options will finish in-the-money. Because of this, the trading stock options will trade just like the stock; penny for penny, dollar for dollar (in a theoretical 100 delta scenario.) If you recall, the term delta was mentioned when describing the option in question. Delta is the first derivative of the stock and it has a three pronged definition. The first is percentage change. The delta is given as a percentage change, meaning how much in percentage terms the trading stock options price will change with a movement in the stock. A 50 delta option will move 50% the amount the stock does. If the stock moves $1.00, than the trading stock options move $.50. A 30 delta option moves $.30 on a $1.00 movement in the trading stock options, and so on. Delta can also be defined as percent chance. This is used to describe the percentage chance that the trading stock options will end up in-the-money. A 90 delta option has a 90% chance of finishing in-the-money. Finally, delta can also be defined as hedge ratio which is the amount of deltas needed to properly hedge a position. It was important to explain the meaning of delta to understand that the deep in-the-money call would perform and act just like trading stock options. One way to determine if the call you will select is in-the-money enough for your purpose is the delta. A delta in the mid or high 90s is an ideal candidate. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Trading Stock Options

|