Investment Options & The Stagnant Scenario Vs. The Down ScenarioProvided By Options University Which Scenario Will Best Your Investment Options?Investment Options & The Stagnant Scenario

When we apply the covered call strategy to the stagnant investment

options scenario, we take a negative return scenario and turn

it into a positive scenario. Remember, when we sell investment

options, we receive a premium for doing so.

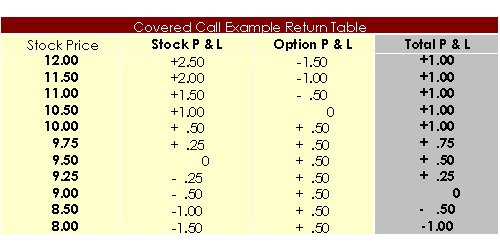

When the stock does not move during the investment options life, the extrinsic value of the investment options goes to zero. The amount of money paid for the investment options goes to the seller. Well take a look at how this sets up. Lets go back to our previous example with the investment options trading at exactly $9.50. We sell the front month, at-the-money call, which would be the 10 strike call. We sell the front month 10 strike calls at $.50. As time goes by, there is less chance for the investment options to become in-the-money. As this happens, the extrinsic value lessens and finally, after Friday expiration, the investment options are worthless. The investment options finish at $10.00 and you have received no capital appreciation but you have received the full $.50 of extrinsic value from the investment options sale. If the studies are correct and selling the premium works 80% of the time, then you will collect approximately $4.00 per contract sold over the course of the year. As the examples demonstrate, writing covered calls against stagnant investment options can provide you with an acceptable return instead of frustration, wasted time and capital. Investment Options & The Down Scenario In the final scenario, where your investment options purchase is headed down into negative territory, the covered call strategy can help minimize your losses. Although picking losers and incurring losses is inescapable, it can be minimized and controlled. Lets take a look at how the buy-write can help us do that. For example, lets say you buy some investment options for $9.50 and at the end of the month the stock had traded down to $8.50, you would have a $1.00 loss on our investment options. However, if you had sold the 10 strike calls for $.50, you would only have a $.50 loss. You would have a $1.00 capital loss in the stock, but a $.50 option gain from selling the investment options, which would expire worthless. If you were going to buy the investment options anyway and incur a possible loss, it is better to take a $.50 loss than a $1.00 loss. In this down scenario, the option premium received helped to offset the capital loss. If the investment options are down more than the amount you received for selling the call, then the option premium serves as an offset to the loss of the investment options. However, you can still make money in the down scenario using the covered strategy if the investment options are only down a small amount. There is a scenario in the buy-write strategy where you can profit from owning investment options that are lower than where you bought it. Going back to the previous example, you bought into investment options for $9.50 and you sold the front month 10 strike calls for $.50. At expiration, the investment options finish down $.20 at $9.30 You would have incurred a $.20 loss on your stock. However, with the investment options at $9.30, the 10 strike call that you sold for $.50 is now worthless. So, you have a $.20 loss on the investment options and a $.50 gain from the option premium sold. This leaves you with a gain of $.30 on the investment options, that is down $.20 since the time you purchased it. To recap: in our third scenario, the down scenario, your loss will be offset by the option premium you received so your loss will not be as severe. You still may incur a loss, but it will be minimized, and minimizing losses is a key to successful investing. For a complete breakdown of these three scenarios, please refer to the table below:  Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Investment Options

|