The Collar Option StrategyProvided By Options University How The Collar Option Strategy Can Influence Your ProfitsThe Collar Option Strategy

Another protective option strategy that allows for some upside

capital gain while providing maximum down side protection is

the collar option strategy.

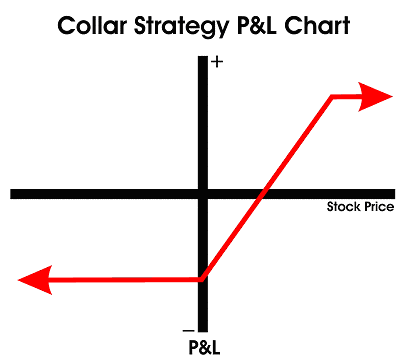

The collar option strategy is a combination of the covered call option strategy and the protective put option strategy. The collar option strategy uses a long put position in coordination with a short call position along with a long stock position. The ratio is one short call, one long put (not of the same strike) and 100 shares of stock.

As you remember, one contract is equal to 100 shares. The options that we will use to construct this option strategy will be out-of-the-money puts and calls. The object here is to construct a protective put option strategy without having to pay for the purchase of the put. We talked about premium in the covered call option strategy and how we are better off collecting premiums over a period of time, not paying them out. By selling the call, we collect premium which can be used to offset the capital outlay we incurred for the put purchase. We said that two of three scenarios in the covered call option strategy were positive while the protective put scenario had only one scenario that produced a positive outcome. However, the protective put was the option strategy that provided the most downside protection. The challenge was to construct a protective put option strategy without paying out money. The solution is the collar strategy. The collar takes on the characteristics of both the protective put option strategy and the covered call option strategy. Like the covered call option strategy, there is an upside cap on profits and like the protective put option strategy there is unlimited downside protection. Ideally, the collar is set up to be an even trade meaning you neither receive nor pay out any money. Realistically, depending on the options used, you may have to pay out a small premium or even receive a small premium but the goal of the collar in terms of premium is to be neutral. As mentioned previously, to construct a collar, just buy one out-of-the-money put and sell one out-of-the-money call per every 100 shares of stock owned. Obviously, the put and the call must be of differing strikes (it is impossible for a put and a call of identical strike price to both to be out-of-the-money or both to be in-the-money). For example, with a stock priced at $28.50 a collar may be constructed by the purchase of the December 27.5 puts and the sale of the December 30 calls. Hopefully, the price of the call and put are close enough so that the funds generated by the sale of the call are enough to offset the cost of the put purchase. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Options Strategy

|