LLY Chart - Collar Options Training Example #1Provided By Options University Follow This Example Of For Successful Options Training NOTES ON ELI LILLY (LLY) Collar Options Training

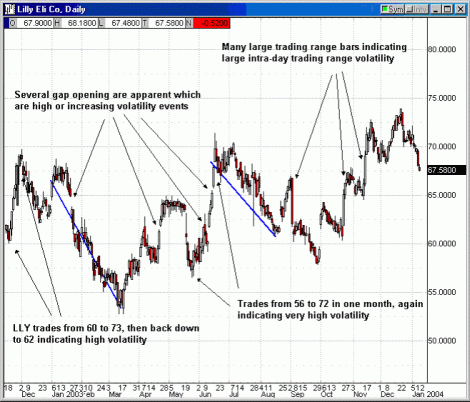

1. In a one month span from Nov. 18, 2002 to Dec. 18, 2002 LLY

traded from just below $60.00 to just below $70.00 and back

down to $62.00.

2. In another one month span from late May 2003 to mid-June 2003, LLY traded from $56.00 up to $72.00. 3. Several gap openings are also apparent with one in mid-January 2003, one in late August and one in very late September. These all point to periods of high or increasing volatility. 4. We also want to notice the individual daily trading ranges. The length of the lines shows the number of large range days. The longer lines indicate larger intraday ranges. In the chart above, LLY shows a very high number of large intraday movement days, again pointing to high volatility. 5. As much as LLY had strong run-ups, it had some large down periods also. In a 2 month period from mid-Jan. to mid-March 2003, LLY traded down from $68.50 to $58.00. Then in another two month period, mid-June to mid August 2003, LLY traded down from $71.00 to $61.00. Conclusion to the LLY options training: LLY appears to be a very volatile stock during the observed period charted above. The stock began this options training period at around $60.00 and finished the period at $67.00, which is not necessarily a large move. But when we look at the large intra-month ranges, its clear that LLY has been very volatile during this period. With this type of movement, a maximum protection options training strategy is necessary but, with such high volatility in this options training example, premiums will likely be expensive. The outright buying of a put may cut too deeply into potential profits making the risk reward scenario unjustified. The collar options training strategy, however, will provide the necessary downside protection, while still allowing room for some capital appreciation. The sale of the call will offset the cost of the put purchase to make the trades risk/reward scenario more viable. The collar options training can be leaned to provide either more protection or more capital appreciation, depending on the investors short term outlook. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Options Training

|