Introducing The Amazing Repair Stock Option Trading StrategyProvided By Options University How This Stock Option Trading Strategy Will Change The Way You Trade

Introducing the amazing repair stock option trading strategy.

This stock option trading strategy involves buying one at-the-money

call option while simultaneously selling two out-of-the-money

call options on the same stock, in the same month.

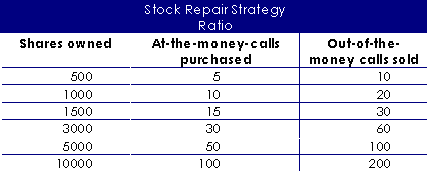

The construction of this stock option trading strategy is critical. First, you must make sure to purchase exactly the equivalent amount of at-the-money call options as shares of stock you own. Remember, each option contract is worth 100 shares. So if you own 500 shares, then you would purchase 5 at-the-money calls. If you owned 3000 shares then you would purchase 30 at-the-money calls. Now that you have purchased the correct and exact amount of at-the-money calls, you then must sell exactly twice the amount of out-of-the-money calls for this stock option trading strategy to work. Again, it is imperative that you sell exactly two times the amount of out-of-the-money calls as the amount of at-the-money calls you own. Looking at the case in which you owned 500 shares and bought 5 at-the-money calls, you would then have to sell 10 out-of-the-money calls to properly construct the repair stock option trading strategy. Likewise, in the case where you owned 3000 shares and bought 30 at-the-money calls, you would then have to sell 60 out-of-the-money calls for proper repair stock option trading strategy construction. Heres why you must follow these steps for this stock option trading strategy to work. The 500 shares of stock you have, along with the 5 call options you just bought, will result in an even spread trade. The reason this is important is because without owning the equivalent of 10 calls (or 1000 shares of the underlying stock), then the 10 out of the money calls you sell would be considered naked and may require an additional margin requirement in this stock option trading strategy. Selling naked calls is considered risky. However, by owning 1000 shares of stock (or 10 call options) at a lower price, your risk is limited because your sold calls are considered covered. The chart below shows some examples of the correct repair stock option trading strategy ratios.  The total dollar value of the options' trade should be neutral or very close to neutral. In this way, you can establish the position without putting out any more money or at least very little. In some cases, you can even put on this trade for a credit, whereby you can sell the out of the money calls for more than you paid for the at the money calls. This scenario is ideal, because then you also profit from this part of the trade also known as a credit spread. (Remember, you will be selling the out of the money calls in a 2:1 ratio to the at the money calls you purchase.) The out of the money calls will invariably be cheaper than the calls you buy, but the 2:1 ratio makes up for the difference in pricing. The easiest way to explain this is by example. Again, we will go back to our XYZ example for this stock option trading strategy. You have purchased 500 shares of XYZ for $40.00. The stock then trades down to $30.00 leaving you with a $5,000 loss. At this point, at $30.00, you would construct the repair stock option trading strategy. (Option prices are for example purposes only.) You would buy 5 February 30 calls for $1.50 and sell 10 February 35 calls for $.75 each. This stock option trading strategy is known as a 1 by 2 spread. Now that the position is in place, you are long 500 shares of XYZ, long 5 February 30 calls and short 10 February 35 calls. Just to clarify, if you were long 1000 shares of stock, then you would also be long 10 February 30 calls, and short 20 February 35 calls. Remember, the ratio of stock, to purchased calls, to sold calls is 1:1:2. Discover these secret option trading strategies that will have your friends calling YOU 'the options expert' Click here!

copyright 2005 Stock Option Trading Strategy

|